Governor Patrick’s and Lieutenant Governor Murray’s fiscal year 2011 budget proposal maintains our commitment to the Commonwealth’s historic health care reform initiative. The Administration has implemented an innovative, thoughtful legislative vision which has transformed the way that the Commonwealth’s residents access health care and has made Massachusetts a national model for how to expand coverage to virtually all of our residents. Today, over 97 percent of our residents have health insurance.

Health care reform in Massachusetts is an unprecedented initiative to expand health insurance coverage. Nowhere in the nation had policies like an individual mandate or minimum creditable coverage been tried or tested prior to health care reform in our state. A groundbreaking legislative framework delegated key implementation decisions to state and independent agencies led by the Administration – with success requiring expert policy judgment and the ability to maintain support among a diverse coalition of stakeholders.

Since Governor Patrick took office in 2007, he has committed himself and his Administration to making health care reform a success. Within weeks of taking office, he was on the phone with health plan executives demanding and delivering lower rates for our residents – and filing a budget making significant investments in health care reform. He secured an extension of our Medicaid waiver that expanded our ability to leverage federal support for health care reform. Last year, he led a successful charge to include additional Medicaid matching funds in federal stimulus legislation. Through his Administration’s role on the Connector Board, the Governor has navigated some of health care reform’s most challenging policy decisions – in particular, launching an “individual mandate” that produced gains in coverage without fracturing the health care reform coalition.

Thanks to these efforts – and the continuing commitment of the Legislature and a diverse coalition of stakeholders – health care reform in Massachusetts has been a tremendous success. Over 97 percent of our state’s residents have health insurance, with gains in coverage that have given us the highest rates of insurance in the nation. Coverage levels have held steady even in the midst of a dramatic national economic downturn – a testament to the wisdom of the statutory framework for reform and the Administration’s sure and steady approach to implementation.

Percentage of Massachusetts Residents Without Health Insurance

Source: Massachusetts Division of Health Care Finance and Policy. Key Indicators Report. November, 2009.

Across our state, we have seen how our residents have benefited from health care reform. Because of the steps we have taken to make health insurance more affordable and accessible, there are countless people throughout the Commonwealth who have access to their own doctor – or life-changing medications or procedures – for the first time. We see gains in access to preventive care, less underinsurance, and a stronger financial safety net protecting our residents against an unconscionable situation of bankruptcy due to medical costs.

Health care reform benefits not just our residents but also our economy. Healthier people mean a more productive workforce for the Commonwealth. Likewise, investing in health care strengthens our world-renowned medical sector – a source of daily medical miracles; an engine for job creation; and a magnet for research dollars and human talent. The Administration’s separate, ground-breaking investment in life sciences creates enormous potential synergies with our commitment to health care reform, together ensuring Massachusetts’ status as the world leader in health care.

The Administration has carefully managed the finances of health care reform, delivering expansions in coverage without breaking the back of the state budget. Independent, non-partisan analysis underscores that the incremental state costs of health care reform have been moderate and in line with original expectations. The model is working as intended – with the costs of expanding state coverage partly offset by lower expenses for uncompensated care; a continuing strong financial partnership with the federal government; and an enduring commitment by the vast majority of our employers to offer coverage to their employees instead of relying on the state to do so.

Employers Offering Health Insurance:

Massachusetts Compared To The Nation

Source: Massachusetts Division of Health Care Finance and Policy. Results from the 2009 Employer Survey. January, 2010.

Even with the national economic downturn, the public and a broad coalition of stakeholders has continued to support health care reform, which the Administration has protected during a dramatic downturn in state tax revenues.

Governor Patrick’s and Lieutenant Governor Murray’s fiscal year 2011 budget maintains our commitment to health care reform and builds on this story of success. Health care reform sets Massachusetts apart – cementing our reputation as a world leader in health care, a policy innovator, and a caring Commonwealth. Whatever the economic and fiscal pressures, we have not backed away from health care reform. Our state cannot afford to do so without jeopardizing the health of its residents.

The Administration’s fiscal year 2011 budget preserves eligibility for state health insurance programs – because over a million residents of this state rely on that coverage; our economy needs us to invest in the health of our residents; and our values demand it. Across state health programs, the Administration is devoting resources to allow more people who need access to coverage to enroll. We are also minimizing additional cost-sharing for our residents, recognizing that, in these challenging times, people need relief from health care costs, not additional burdens.

These policies embodied in our fiscal year 2011 budget proposal – filed amidst continuing economic and fiscal challenges – directly reflect the Governor’s commitment to health care. These goals are accomplished through prudent purchasing, innovative approaches to get the best value for every dollar of state health care spending and the likely success of our coordinated efforts with other states to secure an extension of the enhanced Medicaid matching funds that the Governor first delivered a year ago.

The fiscal year 2011 budget is an important statement of the Administration’s continuing commitment to health care reform. But the Administration’s efforts to improve the quality and affordability of health care extend well beyond the state budget.

In particular, the Administration inherited a longstanding, national and state problem of rapidly growing health care costs for families, businesses (particularly small businesses) and government – escalating at rates that outstrip their capacity to keep up. This problem was not created by health care reform, but it does threaten the long-term sustainability of reform and, more fundamentally, force harmful choices between paying for health care and meeting other family needs, creating jobs or investing in other important public priorities.

Governor Patrick has rolled up his sleeves and begun the hard work of health care cost containment. His Administration has broken new ground on health care payment reform, securing unanimous endorsement of a nationally heralded blueprint to reward value instead of volume when it comes to paying for health care. Moreover, responding directly to concerns raised by small businesses, the Governor has launched a series of intensive hearings by his Division of Insurance on health insurance premium increases and the factors that drive them.

Just as has been the case with health care reform, the cost containment initiatives launched by Governor Patrick have Massachusetts once again leading the nation and charting the path to higher-quality, more affordable health care for all.

The Administration’s fiscal year 2011 budget continues to fully fund state health insurance coverage. Despite the significant fiscal pressures facing the Commonwealth, the budget maintains eligibility for state health insurance programs, a marked difference from the approach in prior fiscal crises.

The Massachusetts Medicaid program provides comprehensive health insurance to approximately 1.2 million low-income Massachusetts children, adults, seniors and people with disabilities. Health care reform expanded MassHealth eligibility to children with incomes up to 300 percent of the federal poverty level and broadened eligibility for the Insurance Partnership Program to individuals up to 300 percent of the federal poverty level. It also restored certain benefits that had previously been eliminated.

The Administration’s fiscal year 2011 budget includes $9.84 billion for the MassHealth program. This is 6.5 percent higher than fiscal year 2010 estimated spending of $9.237 billion. The fiscal year 2011 budget fully maintains eligibility for Massachusetts residents and funds projected enrollment growth of 3 percent.

| FY07 | FY08 | FY09 | FY10 | FY11 | Percent Increase | |

|---|---|---|---|---|---|---|

| HMO | 349,042 | 372,403 | 400,030 | 433,152.00 | 461,868 | 6.6% |

| PCC | 293,645 | 302,819 | 313,047 | 357,943.00 | 362,218 | 1.2% |

| TPL | 185,213 | 189,229 | 188,895 | 152,436.00 | 155,929 | 2.3% |

| Seniors | 106,664 | 108,629 | 109,761 | 112,400.00 | 113,837 | 1.3% |

| FFS | 161,091 | 166,204 | 166,188 | 164,212.00 | 162,896 | -0.8% |

| Total | 1,095,655 | 1,139,284 | 1,177,921 | 1,220,143.00 | 1,256,747.29 | 3.0% |

| % Change | 5.1% | 4.0% | 3.4% | 3.6% | 3.0% |

Programs with significant increases include the Children’s Behavioral Health Initiative (CBHI), Adult Day Health, Personal Care Attendants, Day Habilitation and Home Health. The budget also keeps MassHealth affordable for its members. Due to smart fiscal management and leveraging the most value for our spending, the only additional cost-sharing for members is a $1 increase in co-payments for generic drugs, and this modest increase will not be applied to antihyperglycemics, antihypertensives and antihyperlipidemics (which are used to manage and treat long-term chronic medical conditions).

The budget keeps MassHealth costs affordable for the state and members by maintaining appropriate discipline on rates, introducing new program integrity measures and restructuring adult dental services. The MassHealth adult dental benefit is restructured to cover preventative and emergency services only, excluding restorative dental services. This change will not impact children or intellectually disabled members with active cases through the Department of Developmental Services, and all other members impacted by this restructuring will have access to restorative dental services at Community Health Centers through the Health Safety Net. Revenue initiatives at MassHealth include restructuring payments for prescription drug coverage in managed care plans to achieve higher drug rebate revenues, and expanding the Health Safety Net payer surcharge to Managed Care Organizations serving MassHealth and Commonwealth Care members to provide additional funding for MassHealth and Commonwealth Care.

The Commonwealth Care program was created with the enactment of health care reform. The program provides health insurance coverage for individuals under 300 percent of the federal poverty level that do not have access to employer-sponsored insurance. Commonwealth Care fully subsidizes individuals under 100 percent of the federal poverty level and institutes a sliding scale of member premiums for those above that income threshold. It provides health care services through a fully capitated insurance model. As of January of 2010, there are approximately 150,110 members enrolled in Commonwealth Care, excluding the Aliens with Special Status population (see next section on Commonwealth Care Bridge).

The budget fully preserves current eligibility for Commonwealth Care and provides $838 million to fund additional enrollment in the program in fiscal year 2011 (to fund over 20,000 additional members in the program from current enrollment levels). The budget does not include any increases in Commonwealth Care enrollee premiums. Plan Type 1 co-payments would increase by only $1 for generic drugs, consistent with MassHealth changes, with no co-payment increases for Plans Type 2 and 3. Existing dental coverage for Plan Type 1 members would be restructured in the same manner as MassHealth dental benefits.

Combined funding of $913 million for Commonwealth Care ($838 million) and the Commonwealth Care Bridge program for Aliens with Special Status ($75 million) is 5 percent more than what was budgeted for Commonwealth Care in the General Appropriations Act for fiscal year 2009. Comparing fiscal year 2009 actual spending and the fiscal year 2011 budget proposal, Commonwealth Care spending (including coverage for Aliens with Special Status) has grown by 6.7 percent on average per year.

Aliens with Special Status (legal immigrants who have resided in the U.S. for less than five years) lost eligibility for Commonwealth Care in fiscal year 2010, due to the extreme fiscal challenges created by a national economic downturn and the fact that the federal government does not reimburse states for health insurance coverage for this population. Instead, a separate investment of $40 million was appropriated to provide health insurance for this population. This coverage is now available through the newly created Commonwealth Care Bridge program.

Commonwealth Care Bridge currently provides coverage to about 26,000 Aliens with Special Status, who were enrolled over a three-month period from October to December of 2010. Enrollees have been eligible to receive care through a network of providers that fully meets the Connector’s Commonwealth Care network adequacy standards. While cost-sharing is in some instances higher than that for Commonwealth Care and some benefits are excluded, steps have been taken to reduce any hardships for members.

The Administration’s fiscal year 2011 budget includes $75 million for the Commonwealth Care Bridge program. This program will continue to be run by the Secretary of Administration and Finance, the Secretary of Health and Human Services and the Executive Director of the Connector.

The growth in funding for coverage for Aliens with Special Status reflects the Administration’s continuing commitment to providing health insurance to these legal residents of the Commonwealth. The Administration’s ultimate goal remains fully integrating Aliens with Special Status into Commonwealth Care. While that is not possible in the current fiscal environment (particularly given current federal reimbursement policy), our proposed approach for fiscal year 2011 builds on last year’s accomplishments and thus makes progress towards fully reintegrating this population into Commonwealth Care.

The $75 million proposed for fiscal year 2011 is more than the annualization of the $40 million that will provide coverage for Aliens with Special Status through Commonwealth Care Bridge for about eight months in fiscal year 2010. With that $75 million investment – and with our intention to be aggressive in maximizing its value – our vision and goal is to expand the capacity of Commonwealth Care Bridge. The Administration intends to keep the same benefit and cost-sharing structure for Commonwealth Care Bridge, given fiscal constraints and our goal of maximizing capacity of the program, but will continue to take steps to mitigate hardships.

Overseen by the state’s Division of Health Care Finance and Policy, the Health Safety Net (HSN) reimburses hospitals and community health centers for health care services provided to low-income uninsured or underinsured residents. It was formerly known as the Uncompensated Care Pool. The Health Safety Net is financed by dedicated revenues from a hospital assessment ($160 million) and insurer surcharge ($160 million), other offsetting payments ($70 million) and any state contribution from the General Fund.

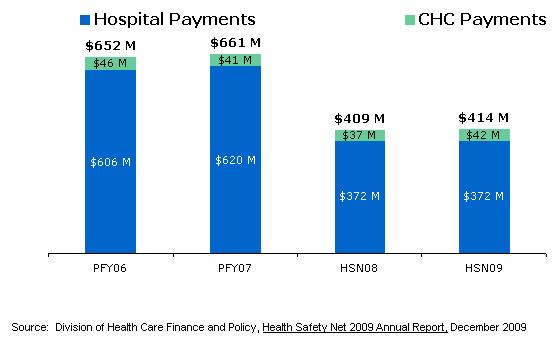

Success in expanding enrollment in health insurance through health care reform has resulted in decreased Health Safety Net utilization and payments. As compared to Uncompensated Care Pool fiscal year 2007, Health Safety Net payments sustained a record drop through Health Safety Net fiscal year 2009 (from $661 million to $414 million).

To help reduce the burden on hospitals in Health Safety Net fiscal year 2010 (Oct. 2009-Sept. 2010) for providing care to the uninsured and underinsured, the Administration intends to dedicate accumulated Health Safety Net fiscal year 2008 and 2009 surpluses (approximately $30 million) to offset 2010 costs. Absent affirmative steps to retain this surplus funding within the Health Safety Net, these funds would flow out of the Health Safety Net. Health Safety Net fiscal year 2010 is currently in progress (only one-third complete). Hospital demand is projected to increase due to the economic downturn (more service use is projected due to the possibility of additional growth in utilization based on past patterns during economic downturns and state policy decisions driven by the economy).

Despite continued fiscal challenges, the Administration is making a $30 million General Fund contribution to the Health Safety Net in its fiscal year 2011 budget proposal – maintaining fiscal year 2010 revenues for the Health Safety Net. We will continue to closely monitor the Health Safety Net to refine projections for fiscal year 2010 and 2011 demand based on updated information.

The Administration has carefully managed the finances of health care reform, delivering expansions in coverage in a fiscally responsible manner. Since its inception, the incremental net cost of health care reform to the state (net of federal reimbursement) is a little more than 1 percent of its entire annual budget. As noted by the independent, non-partisan Massachusetts Taxpayers Foundation, the state cost of health care reform “has been relatively modest and well within early projections of how much the state would have to spend to implement reform.”

Health care reform is working as intended:

Notes on MassHealth:

MassHealth spending includes eligibility and service changes, fee-for-service rate increases, MCO rates under Section 122, and Section 122 supplemental payments, on a date-of-service basis. No enrollment increases besides those that were directly attributable to eligibility changes have been included in this analysis. Does not include supplemental payments to managed care organizations, the non-federal share of which was funded through local revenues (versus state funds) and which accordingly did not result in state costs. Spending for fiscal year 2010 is projected.

Notes on Uncompensated Care Pool/Health Safety Net Trust Fund:

Spending includes offsets from the Medical Assistance Trust Fund. Uncompensated Care Pool/Health Safety Net spending based on UCP/HSN 10/1-9/30 fiscal year. Health Safety Net payments for fiscal year 2009 is based on latest projection. Health Safety Net payments for fiscal year 2010 and fiscal year 2011 are based on available sources.

Notes on Commonwealth Care:

Commonwealth Care spending is net of enrollee contributions.

Notes on Revenue:

FFP includes FMAP on listed spending and Designated State Health Programs (DSHP), and increased FMAP under the federal stimulus bill. The enhanced FMAP for fiscal year 2011 assumes an unemployment tier 3 for the first six months and tier 2 for the second six months. Does not include new revenues dedicated to health care reform (e.g., Fair Share assessment, $1 per pack increase in cigarette taxes).

Additionally, the state has adopted a series of carefully crafted, moderate new revenues that are dedicated to financing and sustaining health care reform, most notably a $1 per pack increase in cigarette taxes that has generated revenue for the Commonwealth Care Trust Fund since fiscal year 2009.

Massachusetts has a high-quality health care system that is a source of pride and prosperity for our state. But costs are a major area of concern. Health care costs are escalating at rates that far outpace every measure of our capacity to keep up.

Growth in Health Spending in MA Expected to Surpass Other

Economic Indicators

Index of Health Expenditures Per Capita and Other Indicators in MA, 1991-2020

Source: Massachusetts Division of Health Care Finance and Policy. Massachusetts Health Care Cost Trends - Historical (1991-2004) and Projected (2004-2020) November 2009

Our health care costs to some extent reflect the price of high-quality care. Yet they are also driven by care that is unnecessary, duplicative or even harmful to patients. Experts believe that approximately 30 percent of today's health care spending produces no benefit to patients. In Massachusetts, we spend a substantial amount of money per year on preventable and unnecessary emergency room visits, hospitalizations and readmissions, while the United States has the dubious distinction of leading the world in duplicative medical tests. At the same time, fewer than half of adults with diabetes in Massachusetts receive recommended screening and preventive care. A better coordinated system of care would address the challenges that the health care industry is currently facing (in Massachusetts and nationally).

These challenges were neither created by health care reform nor first experienced under this Administration. Rather, they are longtime national and state challenges, rooted in the fundamentals of how we deliver and pay for care. Most significantly, the predominant form of paying for health care in Massachusetts has been a “fee-for-service” approach widely recognized as rewarding the delivery of more and more expensive care regardless of whether it is the right care for patients – and promoting fragmentation instead of coordination among doctors and hospitals. We have become heavily-reliant on hospital-based care, while we underpay and lack an adequate supply of primary care providers.

Consumers and businesses directly feel the impact in the form of escalating health insurance premiums. Without comprehensive health care cost and quality transparency – and without any formal oversight and scrutiny of these premiums – they have felt powerless to push back against an unyielding trend of double-digit cost increases.

Total Median Monthly Premiums for Family Insurance Plans

Governor Patrick has not shrunk from the steep and complex health care cost and quality challenges that he has inherited. Rather, he has begun the difficult work of engaging providers, payers, employers and consumers in building a more efficient and accountable health care system that consistently offers our residents the highest-quality care, at a price they can afford. With these efforts well under way, Massachusetts is once again setting new frontiers in health care policy – blazing the trail to more affordable, higher-quality care for all.

As noted by Nobel Prize-winning economist and New York Times columnist Paul Krugman, “So where in America is there serious consideration of moving away from fee-for-service to a more comprehensive, integrated approach to health care? The answer is: Massachusetts.” (NYT, 7/23/09). The Administration is now working with stakeholders to develop approaches to implementation – following the consensus-building model that was essential to the enactment of health care reform three-and-a-half years ago – and developing key data and information technology infrastructure needed to launch payment reform. (see below)

The Governor’s fiscal year 2011 budget proposes eliminating the current sales tax exemption for soda and candy. In addition to generating over $50 million for public health programs, the repeal of this sales tax exemption is a critical first step to discouraging the consumption of these unhealthy items. Net proceeds from removing these exemptions, along with the $100 million in revenues to be collected in fiscal year 2011 from alcohol purchased in package stores, will be deposited into the Commonwealth Health and Prevention Fund to support critical public health programs. All other food products that are currently exempt from the sales tax will remain exempt, in line with the exemption’s original intent to ensure the affordability of necessary goods.

Massachusetts has long been an innovator in health care and public health. The public health programs that serve the people of the Commonwealth reflect the Administration’s commitment to preventative care and wellness services. $151.7 million ($51.7 million of which is new revenue generated from eliminating sales tax exemptions on soda and candy, while $100 million is from last year’s repeal of the sales tax exemption for alcohol) will be dedicated to the Commonwealth Health and Prevention Fund. The fund will be used to support critical programs within the Massachusetts Department of Public Health, including:

| $151.7 Million | |||

|---|---|---|---|

| Account Distribution | Acct # | % Funded from Health and Prevention Fund | Total Wellness Fund Spend |

| Addiction Control Services | 4510-0700 | 100% | $81,184,876 |

| Smoking Prevention and Cessation Programs | 4590-0300 | 90% | $4,725,969 |

| Health Promotion, Violence Prevention and Workforce Expansion | 4510-2500 | 83% | $33,520,467 |

| Children's Health and Nutrition | 4512-0120 | 83% | $32,268,688 |

| Total Wellness Fund Spending | $151,700,000 | ||

Tobacco use is the leading cause of preventable death in Massachusetts. Roughly 9,000 residents lose their lives each year to tobacco-related illness. It is widely acknowledged that even sporadic tobacco use results in costly and fatal diseases such as cancer, hypertension, heart disease and emphysema. Low-income populations smoke at twice the rate of the general adult population (roughly 36 percent compared to 16.4 percent). The costs of treating low-income individuals and the un- or under-insured ultimately fall on the state. Proactive policy measures to reduce tobacco use serve to reduce spending for treating tobacco-related diseases and allow Massachusetts residents to live longer, healthier lives.

In most cases, the decision to begin smoking is made prior to becoming an adult. 60 percent of smokers start by the age of 14, and 90 percent of smokers are firmly addicted before reaching age 19 (Foundation for a Smoke Free America, 2010). Each year in Massachusetts, about 7,000 young people become new daily smokers. If no more young people in Massachusetts started smoking, about 117,000 young people alive today would be saved from disability and death caused by tobacco use (Making Smoking History, 2010). Teenagers and young adults are a particularly price-sensitive demographic. Thus, policies that increase the cost of smoking and tobacco use can help reduce their tobacco use.

The landmark federal tobacco settlement of 1998 resulted in greater monitoring of tobacco sales to underage users and more explicit messaging around the dangers of tobacco use. This helped commence the steady decline of overall tobacco use in America. Massachusetts complemented the achievements of the federal tobacco settlement with the enactment of an additional per pack tax on cigarettes. Each increase in cigarette prices has successfully accelerated the reduction of smoking and smoking-related disease in the Commonwealth.

In 2008, excise taxes on cigarettes were raised by $1 per pack, with the proceeds dedicated to the Commonwealth Care Trust Fund to pay for health insurance coverage. However, purchases of cigars and smoking and smokeless tobacco were omitted from this change. The Administration proposes to close this tax loophole to improve public health and make significant gains in reducing underage tobacco use. The $15 million that will be generated from closing this tobacco tax loophole will be likewise be dedicated to the Commonwealth Care Trust Fund to provide health insurance to low-income Massachusetts residents.